The trading week is about to light up the charts, in case the turmoil in Hong Kong or Brexit political jostling wasn’t making enough waves.

We are set for 4 punchy trading days ahead with the following event & calendar risk ahead:

-

UK Wage data & UK Inflation data

-

Donald Trump speech and possible Trade progress hints

-

Escalating HK Protests slammed the Hang Seng down 1,000 points yesterday

-

US Inflation data & Fed Chair Powell testimony

-

RBNZ likely toperform a “hawkish rate cut” for NZ tomorrow

-

Aussie Jobs data on Thursday with China Industrial production data

The above are the “Big 6” market drivers this week but I mustalso add in the US Bond market as a number 7 driver around the USD sentiment before we round out this trading week with the latest US retail spending data.

Position Notes &Timing Expectations:

-

Mild USD weakness upon US Fed testimony.

-

Lower prices in Gold as $1,450 crumbles away towards my $1,380 near-term target.

-

Potential for GBP rally to begin as the Brexit progress seems to have helped break the political stalemateahead of the December UK election.

-

High potential for a NZD rally as the RBNZ action is close to fully priced in

-

Spanish elections and weaker growth not helping the EUR/USD higher

An exact Trade Idea for Forex from Russell:

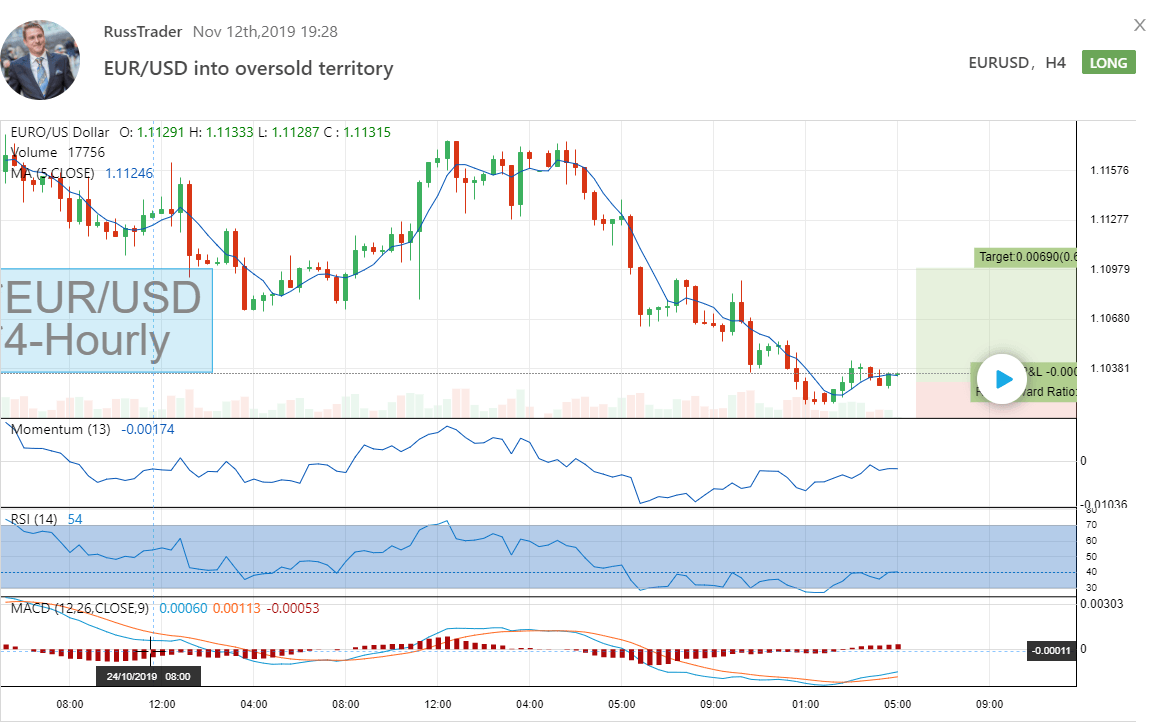

EUR/USD is well into oversold territory and likely to snap back with the US Fed testimony plus US inflation data possibly delivering a soft close for the USD to finish this trading week.

BUY EUR/USD

1.1030

Target

1.1100 (+70 Pips)

Stop

1.0960 (-70 Pips)

"forex" - Google News

November 12, 2019 at 07:00AM

https://ift.tt/32ALFhW

Forex Majors and Position Notes - FXStreet

"forex" - Google News

https://ift.tt/2NYydz4

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Forex Majors and Position Notes - FXStreet"

Post a Comment